[Latest News] US Stock Market Today: Wall Street Reacts to Latest GDP Data

![[Latest News] US Stock Market Today: Wall Street Reacts to Latest GDP Data](https://upload.wikimedia.org/wikipedia/commons/f/ff/Stock_Market_April_5_2025_3_Months.png)

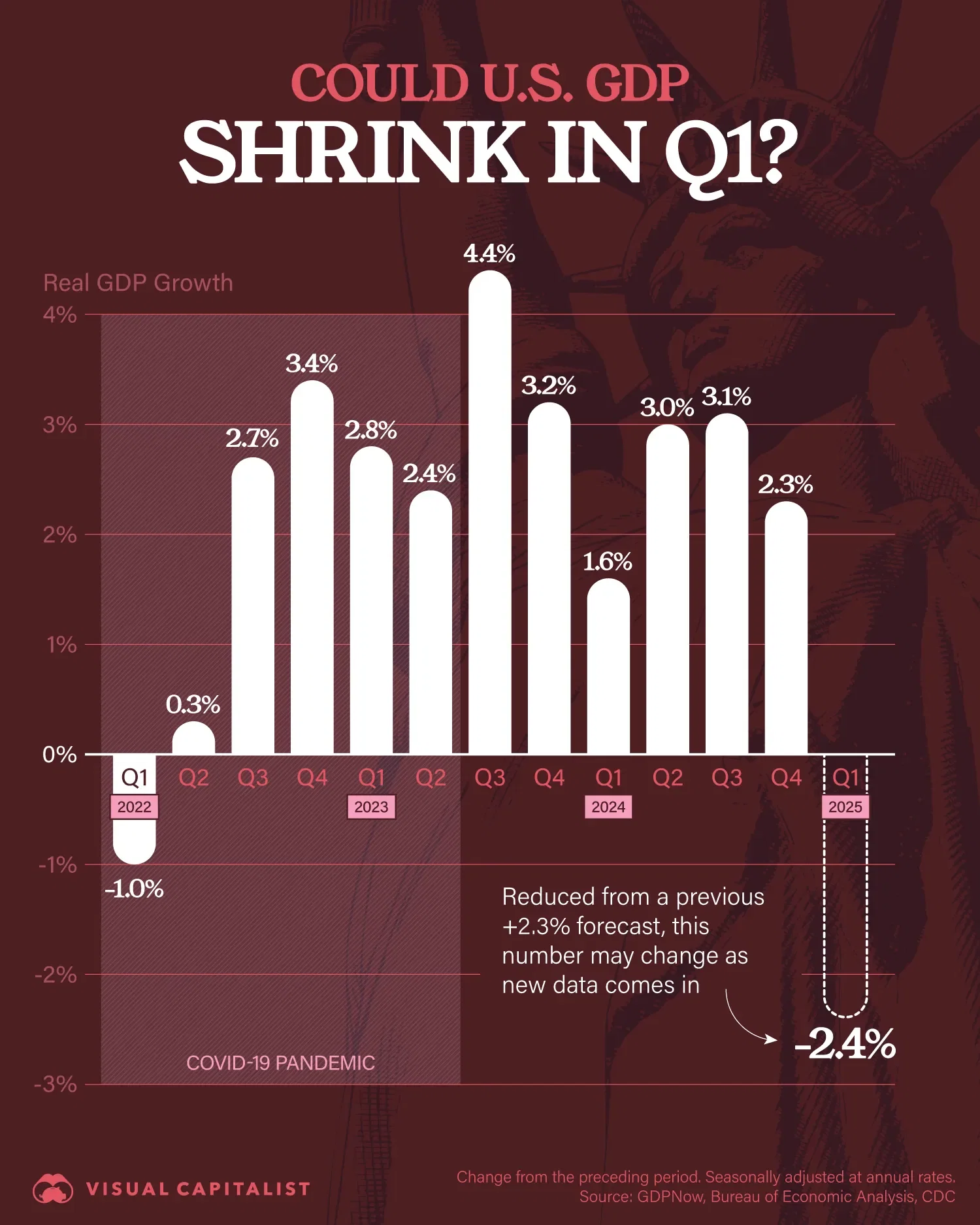

In a week where economic uncertainty looms large, all eyes are on the US stock market today. As the Q1 2025 GDP report was released showing unexpected contraction, Wall Street’s reaction has been swift—and telling.

The numbers have intensified concerns about an economic slowdown, sending ripples across indices like the S&P 500, Dow Jones, and Nasdaq. Whether you’re a seasoned investor or just keeping an eye on your 401(k), today’s developments are critical to understand.

Market Overview: How the US Stock Market Is Moving Today

The US stock market today opened cautiously, with investors waiting for the official GDP figures. Once the data hit—revealing a 1.4% contraction in Q1 2025—markets reacted immediately.

S&P 500, Dow Jones, and Nasdaq Performance Summary

As of the latest update:

- S&P 500 dropped by 1.6%

- Dow Jones Industrial Average fell 0.9%

- Nasdaq Composite tumbled 2.2%, with tech stocks taking a heavy hit

This broad-based decline mirrors growing concerns over economic growth, inflation persistence, and potential interest rate moves by the Federal Reserve.

Key Movers in Today’s Stock Market

- Apple (AAPL) and Microsoft (MSFT) fell over 2%, dragged down by cautious consumer sentiment.

- Goldman Sachs (GS) and other financials also slipped as interest rate outlook dims.

- Oil stocks, like ExxonMobil (XOM), saw gains amid Middle East tension and rising crude prices.

Pre-Market vs. Post-GDP Reaction

Before the GDP report, futures hinted at stability. After the release, however, market volatility surged, and selloffs were swift—highlighting just how sensitive investors are to macroeconomic signals.

Breaking Down the Q1 2025 US GDP Report

The GDP data was the main driver behind today’s market moves. The U.S. economy shrank by 1.4% in Q1 2025, compared to a 0.8% expected growth. This contraction has serious implications.

GDP Growth Rate Compared to Previous Quarters

Q4 2024 had shown modest growth of 1.2%, so this sharp downturn surprised economists. The negative print marks the first contraction since 2022, prompting fears of an oncoming technical recession if Q2 follows the trend.

What Sectors Contributed to the GDP Contraction?

- Consumer spending slowed, especially in goods like autos and electronics.

- Business investment saw a notable decline.

- Government spending remained flat despite stimulus measures.

📰 Read the full BEA GDP report for detailed breakdown.

Expert Commentary on the Economic Slowdown

Economist Laura Kim of JPMorgan Chase stated:

“This GDP miss raises the odds of a stagflationary period—where inflation remains high, but growth falters. That’s the worst-case scenario for markets.”

Investor Sentiment and Market Volatility Explained

Investor psychology plays a big role in market moves—and right now, sentiment is turning negative.

Fear & Greed Index and VIX Analysis

- The CNN Fear & Greed Index dropped to 31 (Fear)

- The VIX, Wall Street’s volatility gauge, surged 18% today—reflecting growing uncertainty

Retail vs. Institutional Investor Behavior

While retail investors are reacting with panic-selling, institutional investors appear to be rebalancing portfolios, moving capital from growth to value sectors and cash equivalents.

Social & Google Trends Insights on Stock Market Anxiety

Google Trends shows sharp spikes in:

- “Stock market crash today”

- “Is the US in a recession?”

- “GDP data 2025”

These signal rising anxiety among the general public, which often translates to further market volatility.

How Economic Indicators Are Shaping Wall Street Trends

Today’s GDP report didn’t come in a vacuum—it’s part of a broader narrative that includes inflation, employment, and the Federal Reserve.

Unemployment Data and Its Stock Market Impact

Unemployment remains low at 3.9%, but job openings have begun to decline. Layoff announcements in tech and finance sectors are beginning to tick up.

Inflation and Interest Rate Expectations

Inflation remains sticky at 4.7%, well above the Fed’s 2% target. This keeps the central bank in a tough spot: raise rates and risk deeper contraction, or hold and risk runaway inflation.

Fed Watch: What Policymakers Might Do Next

Analysts expect the Fed may pause its rate hikes temporarily in light of the GDP miss. However, any hint of further tightening could send markets into a tailspin.

🏛️ Stay updated with FOMC announcements on the Federal Reserve’s site

What This Means for Traders, Investors, and the Economy

Short-Term vs. Long-Term Strategy Insights

Day traders may find volatility attractive, but long-term investors are urged to maintain diversified portfolios. Now isn’t the time for panic, but rather disciplined adjustments.

Sectors to Watch Amid Recession Fears

- Utilities and consumer staples tend to perform better in downturns.

- Tech may suffer short-term but still offers long-term value if bought on dips.

- Watch energy stocks closely as geopolitical tensions rise.

Analyst Forecasts for the Next Quarter

While some believe Q2 could rebound, others warn that the full effect of high interest rates has yet to hit. Most agree: volatility will persist, and data will continue to drive day-to-day sentiment.

Conclusion: Key Takeaways from Today’s Stock Market and GDP Data

The US stock market today is navigating a minefield of mixed signals. A negative GDP print, inflation worries, and uncertain Fed policy have made Wall Street jittery. But amid the chaos, there are opportunities for those who stay informed and think long-term.

Markets are forward-looking, and while today’s headlines are grim, how we interpret them—and position ourselves—matters more.

FAQs About the US Stock Market Today

Why did the stock market drop today?

The stock market dropped due to weaker-than-expected GDP data for Q1 2025, signaling potential economic contraction and triggering investor anxiety.

What does negative GDP mean for investors?

Negative GDP reflects shrinking economic activity. It often leads to lower corporate profits, tighter credit, and a risk-off sentiment in markets.

How is the S&P 500 reacting to the GDP report?

The S&P 500 is down 1.6% as of today, with tech and consumer sectors leading the decline. Investors are repositioning based on economic outlook.